Pain, Gain, and Business Growth

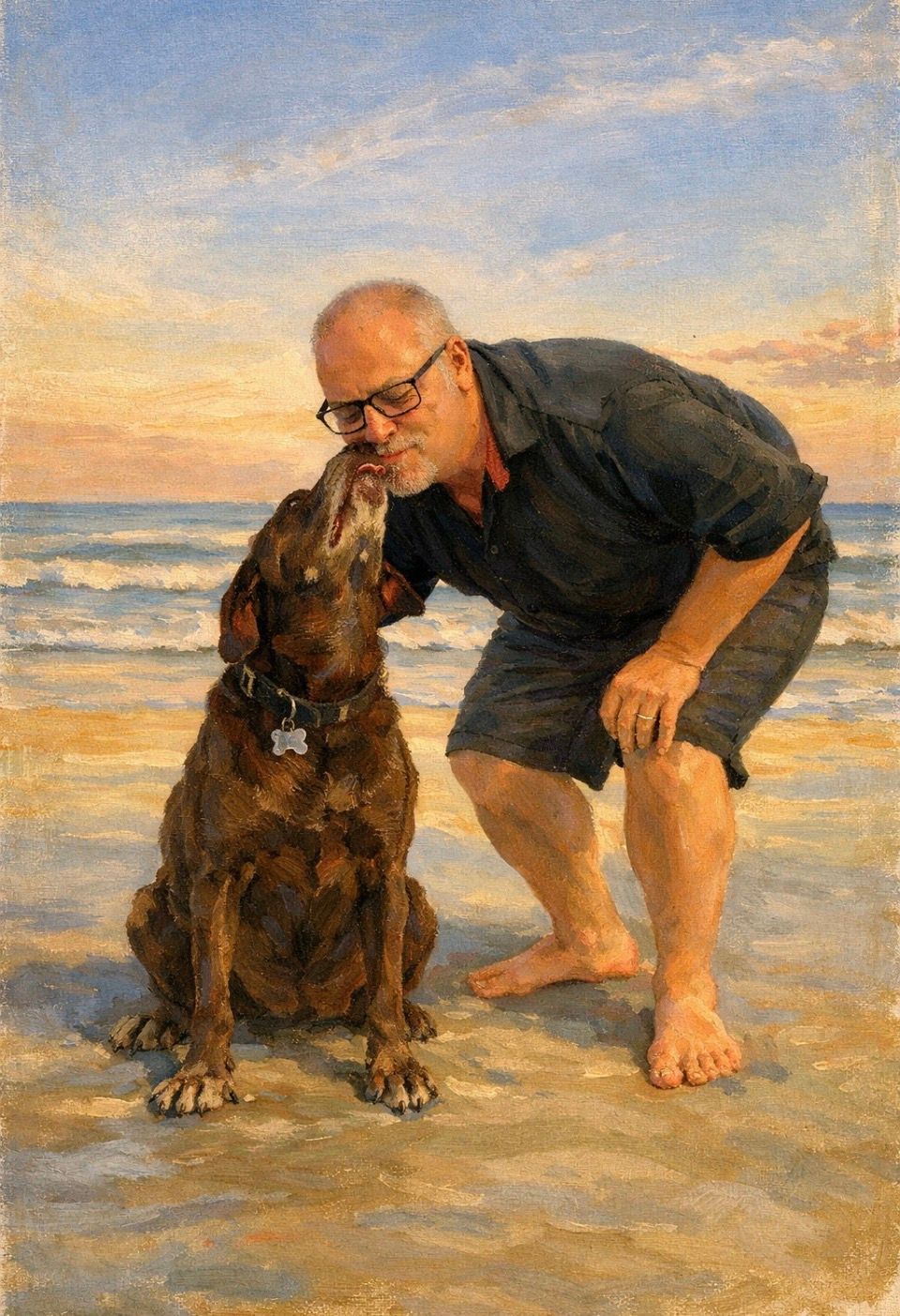

Imagine that you experience a flash of inspiration and conceive a clever idea for a business venture. You quickly execute on your idea and make a fast profit of $10,000. How do you think you would feel? No doubt you would be happy with your success.

Now imagine that instead of a fast $10,000 profit, you immediately lost $10,000. You would feel really bad, discouraged, and upset. In fact, the pain you would experience over losing $10,000 would far exceed the happiness you would enjoy if you had profited by $10,000.

Scientists have studied the human brain and have learned that we are wired in ways that make us experience the pain of loss more deeply than we experience the joy of gain. As Nobel prize winner Daniel Kahneman and Amos Tversky put it: “In human decision making, losses loom larger than gains.”

Savvy marketers and merchandisers understand this. A company selling energy efficient refrigerators does better advertising “avoid losing hundreds of dollars in energy costs” than it does by saying “save hundreds of dollars on energy bills.”

This evolutionary adaptive quirk of human nature – called negativity bias – which makes us feel loss more strongly than gain, has important implications in a variety of business contexts. And it explains human behavior in ways useful for executives managing businesses for growth to understand.

Consider the following experiment by Dean Buonamano and described in his book, Brain Bugs. As with all experiments, there are two conditions. In condition one, participants are given $50 and two options:

Option one: Keep $30

Option two: Gamble the $50 with a 50 percent chance of keeping the entire $50 and a 50 percent chance of losing the entire $50.

Forty-three percent of the experiment participants selected option two: A chance at the whole pot, with an equal chance of losing it all.

In condition two, the first option was this: Lose $20. This time, 61 percent of the participants opted for option two, the gamble option. That’s a statistically significant over 40% increase in people making the least rational decision.

This experiment, and many others like it, clearly demonstrate how risk aversion influences thinking in ways that lead to illogical and irrational choices, often to the decision maker’s detriment.

Consider the following implications for business decision-making and execution, particularly as it impacts managing for growth.

Risk taking: Loss aversion leads to unwise risk-taking. As seen in the experiment described above, more study participants confronted with the pain of loss (lose $20,) made a bad gamble than did participants experiencing the joy of gain (keep $30.) Either way, the risk was a bad one. The decision to forego a certain $30 for a risk-adjusted $25 is plainly irrational.

Decision making and execution: An executive faced with a growth investment decision, such as spending on a program to improve the sales and marketing departments’ performance, will be naturally inclined to reject the proposal.

The discomfort at the thought of losing the amount invested in the program looms far greater in a decision maker’s mind than does the taste of success the program would bring if it works as expected.

Creating business growth: In his book, Thinking Fast and Slow, Kahneman said: “Loss aversion is a powerful conservative force that favors minimal changes from the status quo in the lives of both institutions and individuals.” Where business growth is often based on a model of assessment, planning, and execution, loss aversion can be a major obstacle and source of resistance for managers trying to grow businesses.

The challenge for decision makers is to understand the scientific fact of feeling the pain of loss more intensely than the joy of gain, and to confront and overcome it in the decision making and execution processes. Those who can do so will be more successful in growing businesses than those who cannot.

____________________________________________________________________________________________________________

To learn how Integrated Growth Advisors can help you solve your business challenges, contact Daniel McMahon, at 843.441.2671 or 860.490.5068, or dmcmahon@integratedgrowthadvisors.com