What a Golf Swing Can Teach Us About M&A Deal Integration

Key Takeaways

- Like a golf swing, everything in a merger must be in alignment or else the deal, like a golf shot, will go horribly awry.

- Consistency, focus, visualization, and follow-through are key to success in golf and M&A integration.

- Being impatient and taking shortcuts can lead to hazards on the golf course or in the boardroom.

April 11, 2024 – With March Madness behind us, the sports world turns its attention to Augusta, Georgia for the annual Masters Tournament -- one of the four men's major golf championships in professional golf. The stunning greenery of the Augusta National Golf Club will have much of the Northern Hemisphere thinking about springtime and new beginnings. It’s also when Busy Season finally ends for accounting and tax professionals nationwide and thoughts turn to making things less painful and more efficient for the future, including joining forces with another firm.

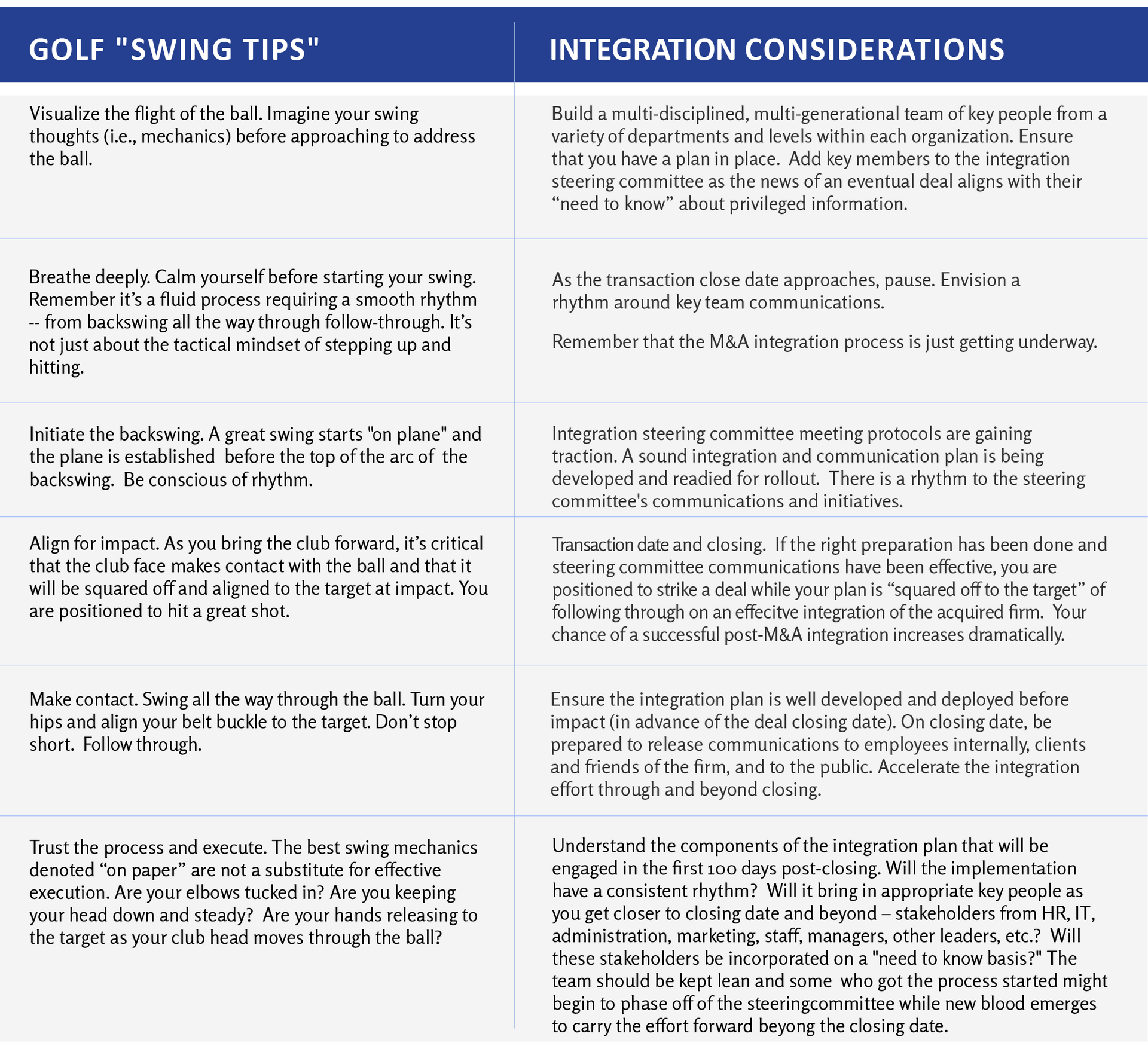

So, what does golf have to do with merger and acquisition activity in the accounting world? It turns out, a lot more than you think. I’ve created an infographic that aligns the best swing tips I’ve received over my years of learning to golf with some select advice I’ve shared with clients about how to make their M&A process smoother and more successful.

As legendary golfer Gary Player once said about the Masters: "Every shot is within a fraction of disaster -- that's what makes it so great." And that’s also what happens when two firms try to come together with vastly different cultures, client rosters and talent pools.

Like a golf swing, everything in a merger must be in alignment, or else the deal, like a golf shot, will go horribly awry. At the moment your ball is actually struck (i.e., the closing date), think of how many things need to be in motion for a golf ball to be hit successfully and to go straight down the middle of the fairway. You must have a backswing that is on plane, a consistent rhythm, and a really good follow through. Same goes for your pre- and post-merger game plan. If you’re on the M&A integration team, you must stay in rhythm and never lose focus. Because once you take your eye off the ball, things can break down quickly whether you’re on the golf course or in the M&A war room.

Swing tips and Integration Considerations

Outlined in the chart below are six key phases of a golf swing and six key points for consideration, which relate to the integration of a purchased accounting firm before and after the deal closing date.

Don’t take shortcuts

Golf is not an easy game to learn; it’s even hard to master. One of the biggest mistakes I see golfers at all levels make is trying to take shortcuts. It takes practice, patience and resiliency (just like a firm merger). Inevitably you will hit a bad tee shot and find yourself behind a tree. A patient golfer knows you have to work yourself out of trouble one step at a time – one shot to get out from behind the tree and a second shot to get back on track. You “take your medicine” and live to play another day. But, too often I see players try to “save themselves” with one heroic shot even though the odds of making that shot are 2% at best. More often than not, they make things worse by bouncing off another tree, or winding up deeper in the rough, buried in a sand trap or sunk at the bottom of a water hazard. The same theory applies to an M&A transaction when both sides take short cuts or try to go too fast. As with a golf swing, a successful transaction must keep everything in rhythm and in sync.

Conclusion

I continue to learn the game and work on my own improvement as a player. My swing has evolved from my Dad informally teaching me how to swing a golf club in the backyard to developing lots of bad habits as a “do-it-myselfer.”

I didn’t experience true results until I committed to learning how to swing a golf club like a true golfer. It wasn’t until I started to get coaching from a true PGA teaching professional that I found the discipline—and aligned the resources—to learn a golf swing the right way.

Likewise, a CPA firm leader who aligns with a trusted M&A advisor has a much better chance of seeing their M&A transaction go as smoothly as possible and find success in the newly combined firm.

Do you have a favorite swing tip or M&A integration tip you’d like to add to the chart? I’d love to hear about it.

Please contact me at 877-442-4769, x701 |

dmcmahon@integratedgrowthadvisors.com.

Daniel J. McMahon, a CPA and Certified Merger & Acquisition Advisor, is the Founder & Managing Partner of Integrated Growth Advisors (IGA), a value creation and growth advisory firm focused on empowering business leaders to systematically enhance their revenues, profitability, sustainability, and value. IGA creates sustainability and transferability—and wealth—for business owners by addressing common issues relating to growth, control, and transition of ownership. IGA has been serving clients throughout the United States since 2011.